News

PIB reveals first purchase since Gallagher talks ended

PIB Group has bought general insurance specialists Guernsey-based Ross Gower Group, expanding its presence in the region.

Home insurance premium falls accelerate in Q3

Insurance premiums for home insurance continued their downward trajectory in the third quarter of 2025, according to the latest data from Pearson Ham Group’s General Insurance Price Index.

HSB launches cyber insurance and incident response solution for SMEs

HSB has launched a cyber and incident response solution for micro and small businesses in the UK and Ireland with revenues up to £10m.

Arch names Cleary as Leeds branch manager

Arch Insurance UK Regional Division has appointed Martin Cleary as Leeds branch manager, joining from Bravo Network.

Carrow launches UK accident and health products

Carrow Insurance, a specialist managing general agent, has launched accident and health covers in the UK, tailored for corporate and affinity business.

Brown & Brown seals All Medical Professionals deal

Brown & Brown has bought specialist digital broker All Medical Professionals which trades as All Med Pro Dental.

Ex-PIB and Aon leader Butler joins Kingfisher as head of corporate risks

Kingfisher Insurance has named Gareth Butler as head of corporate risks.

US consolidator buys London-based £100m GWP MGA

US-based managing general agent consolidator Bishop Street Underwriters has acquired Avid Insurance, the niche multi-disciplined MGA.

Chaucer launches cyber offering

Chaucer has launched a cyber risk management and insurance solution, Vanguard, with available limits up to $15m (£11m) for cyber liability.

RSA/NIG brands end as Intact name comes into force

Ken Norgrove, CEO of Intact UK and Ireland, has detailed plans to double the size of the business to £5bn by 2030, as RSA and NIG rebrand to Intact Insurance.

Howden expands into North Wales with latest buy

Howden has purchased Llandudno, North Wales-based broker, Gott & Wynne, expanding its presence into the region.

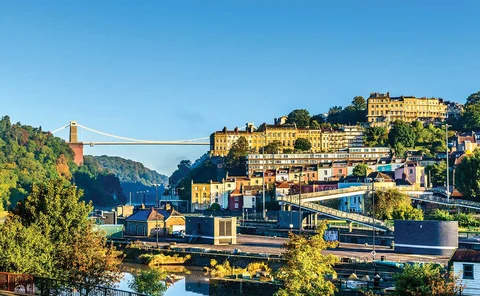

Partners& opens South West hub

Partners& has opened an office in Bristol and recruited two protection advisors.

Maxwell to succeed Graham when she retires as Airmic CEO next year

Airmic has named Diane Maxwell as its incoming CEO as it confirmed Julie Graham will step down in April next year.

Willis stakes claim for parametric first with weather warning trigger

Willis has staked a claim for a market first with the launch of a parametric policy which will payout in the UK and Ireland on a red weather warning rather than due to the event hitting.

People Moves: 29 September – 3 October 2025

Keep up to date with the latest personnel moves in insurance.

Dual seals five-year capacity deal led by Zurich

Howden-owned managing general agent Dual UK has signed a five-year capacity deal led by Zurich, along with Liberty and other A-rated capacity to support its new regional commercial combined product.

Ex-Tempcover team launch new short-term insurance broker Covertime

A team of senior ex-Tempcover employees has formally re-entered the UK insurance market with Covertime, a new start-up broker focused on short-term cover.

Brunel launches specialist tech broker

Brunel Group has launched BrunelTech, a specialist broker for the technology industry.

MGA Ripe names second CUO in less than a year

UK Digital MGA Ripe has appointed Sean Carney as its new chief underwriting officer.

Bexhill owner tops £120m in lending

Orchard Funding Group, owner of premium finance lender Bexhill UK, has posted a record lending total of £121.8m for the year ended 31 July 2025, with profit-after tax jumping to over £3m.

SSP enters operating profitability following sales growth and expense reduction

SSP has reported £5.05m in operating profit for the year ending 31 December 2024 putting it into the black from a £861,000 loss the year prior.

New research claims 60% of HNW customers have suffered escape of water

Research from Ecclesiastical has found 60% of high net worth property owners have experienced an escape of water incident in the last five years.

MGA completes MBO from broker parent

Blackthorn has sold its MGA subsidiary Samphire Risk via a CEO-led buyout backed by Kantara Capital.

New MD takes the reins as loss adjusting firm completes MBO

Independent loss adjusting business Williams Pitt has undergone a management buy-out.