Statistics

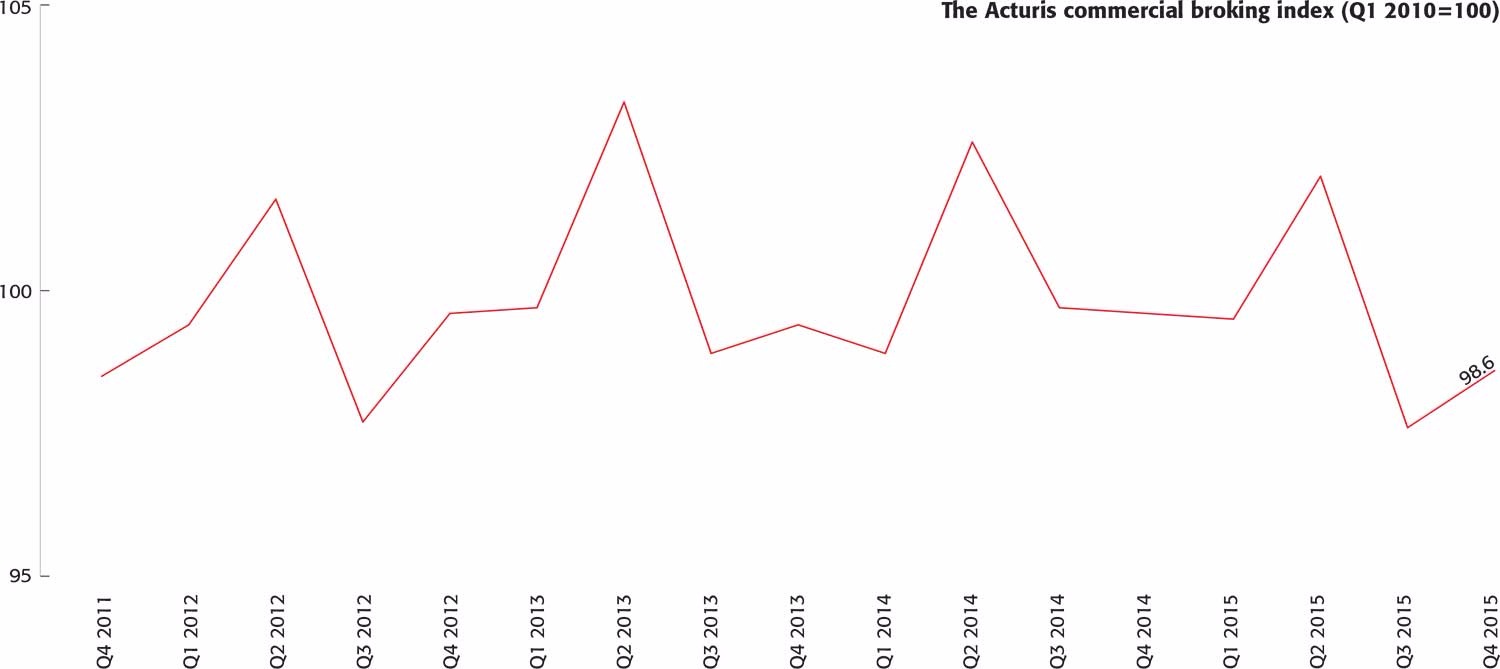

| Explaining the figures The Acturis commercial broking index consists of quarterly figures calculated on a base line of the first quarter of 2010. It has been designed to represent premium movements in a typical broker’s book of commercial business. This index uses weighted figures from commercial combined (35%), fleet (25%), property owners (18%), packages (12%) and combined liability (10%) indices based on the portion of GWP each class of business represents in a typical commercial book. The further indices in the Acturis Premium Index covered in the text show year-on-year comparisons measured across £5bn of premium. The movements in premium can be driven by changes in the size of the risk and the level of the insurance rate. By comparing each quarter with the same period the year before it is most likely to set the pricing of similar risks against each other. |

Four of the seven classes of business covered by the figures show percentage falls in average premium price quarter-on-quarter according to the index. Property owners and commercial combined were the biggest fallers, while tradesman and combined liability were the largest risers. The statistics show the commercial broking index – averaging all of the classes of business (see box for full explanation), was down in the final three months of last year contrasted with the same period in 2014.

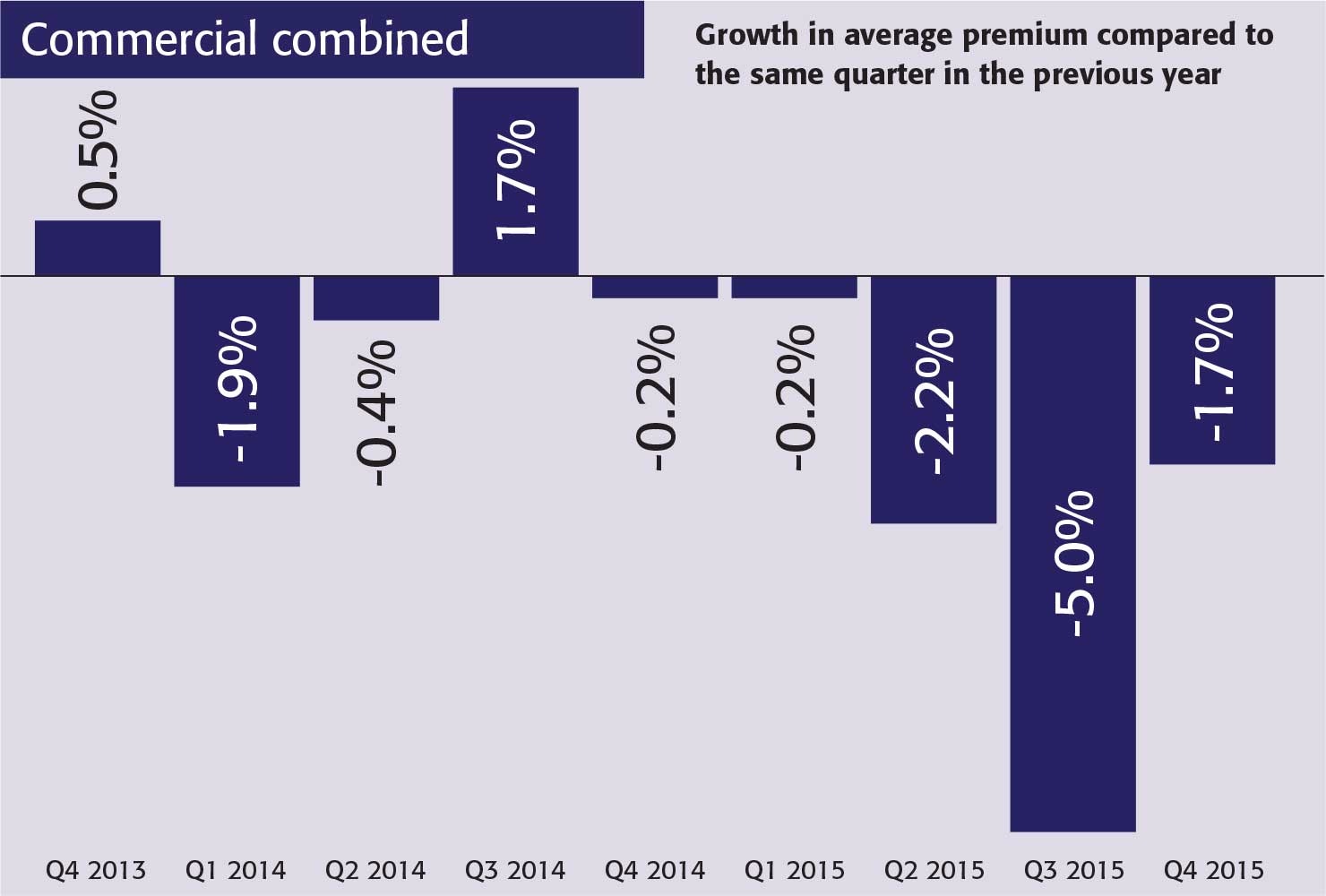

Looking at the classes of business individually, commercial combined fell 1.7% in the fourth quarter of 2015. Craig Roberts, commercial broking director at JSW Insurance, which is part of The County Group, said he wasn’t surprised by the reduction. “It underlines the fact that there is still too much capacity out there,” he explained. “Insurers are fighting over the same business and the rates that are being offered in the marketplace in reality are too cheap.”

Ben Leah, a director at Hayes Parsons, noted the fall in commercial combined is a continuing theme with negative numbers stretching back five quarters. He suggested insurers are chasing market share at the expense of underwriting discipline in the pursuit of growth.

Leah continued: “We are in a downwards trend at the moment. It’s not necessarily a race to the bottom but a race to grab as much market share as insurers can while their CORs are healthy and they have the mandate to grow their top line as much as possible.

“I don’t think we are seeing any signs of rates stabilisation, let alone increases.”

More insurers are now writing commercial combined type business electronically, Roberts pointed out. “If an insurer is writing it on an electronic trading platform their rates are lower than doing it on a manual basis because their costs of servicing that business are much lower, so it’s reflected in the premium level.”

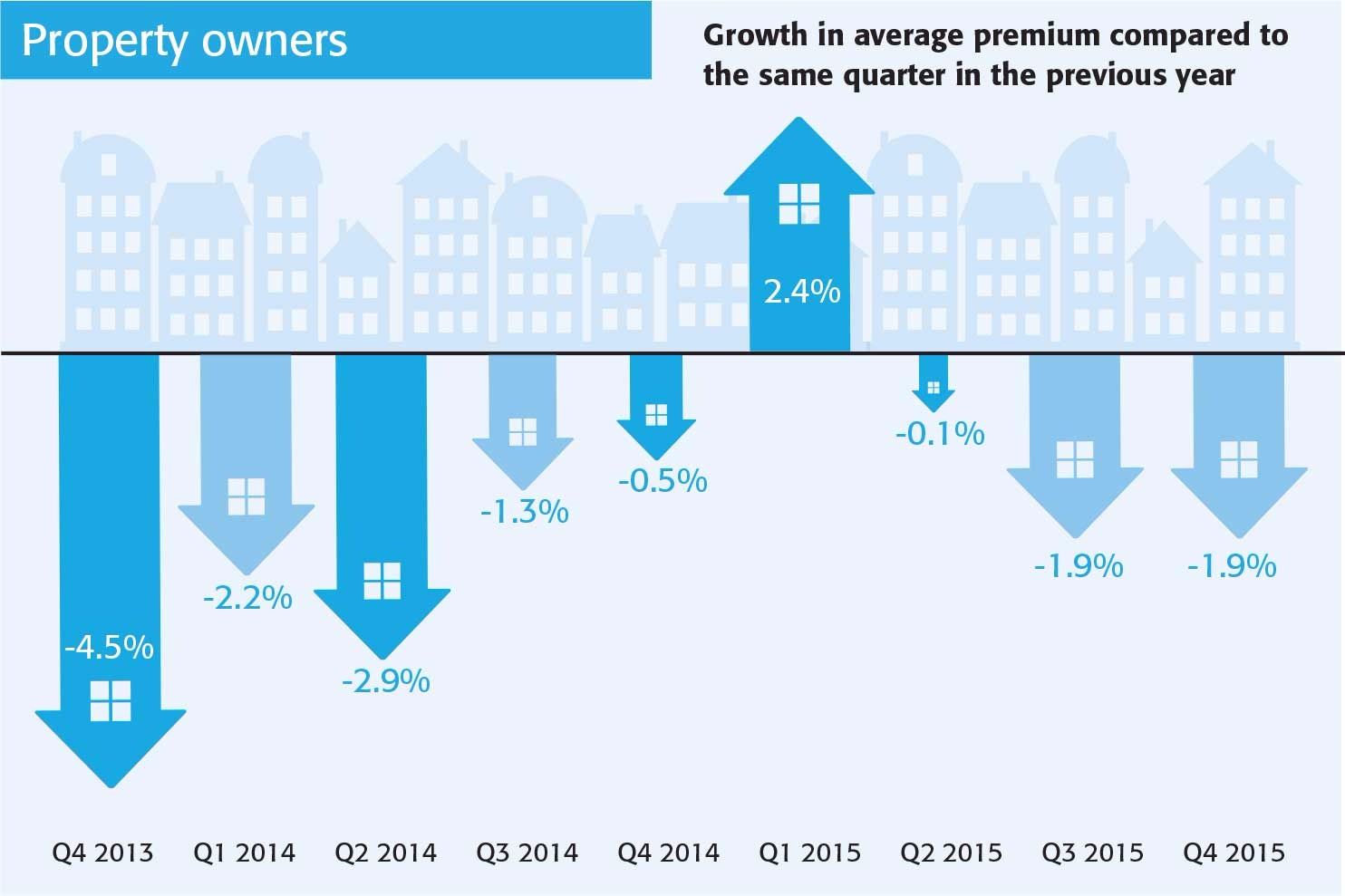

The other main faller was property owners which recorded a fall of 1.9% for the last three-month period of 2015. It has been marked by falls in most quarters since 2011 according to the Acturis index which tracks about £5bn of premium overall. Roberts commented: “Every insurer who comes through my door will say ‘we want property owners business’ and they’re all fighting for it, and it’s reflected in the rate they’re writing it at.”

Insurers clamouring for that book of business is a sentiment echoed by Leah, who attributed the interest to its profitability and the opportunities it provides to sell associated products. In his view, as we progress into 2016, the numbers for property owners will show quite a marked fall.

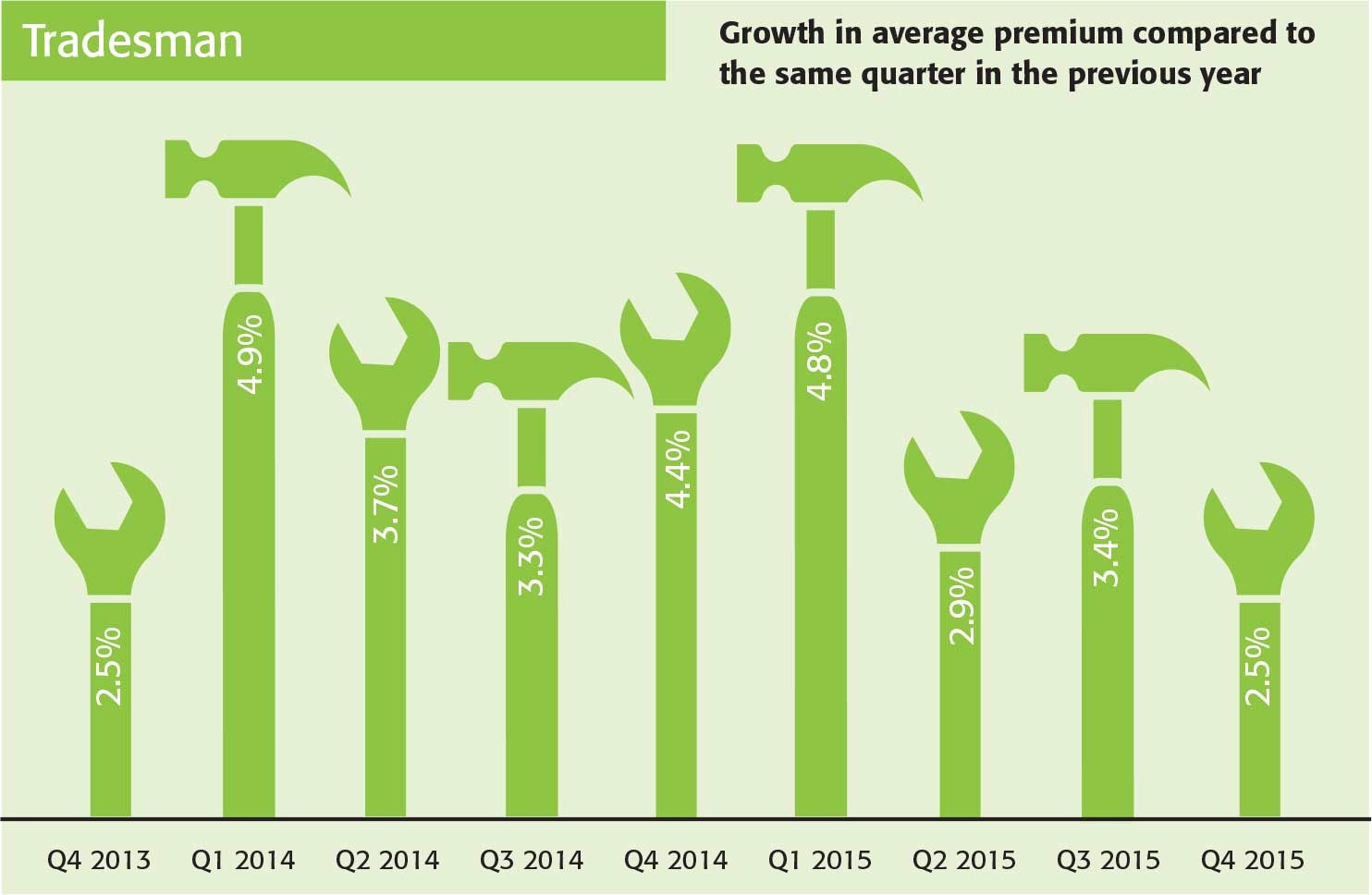

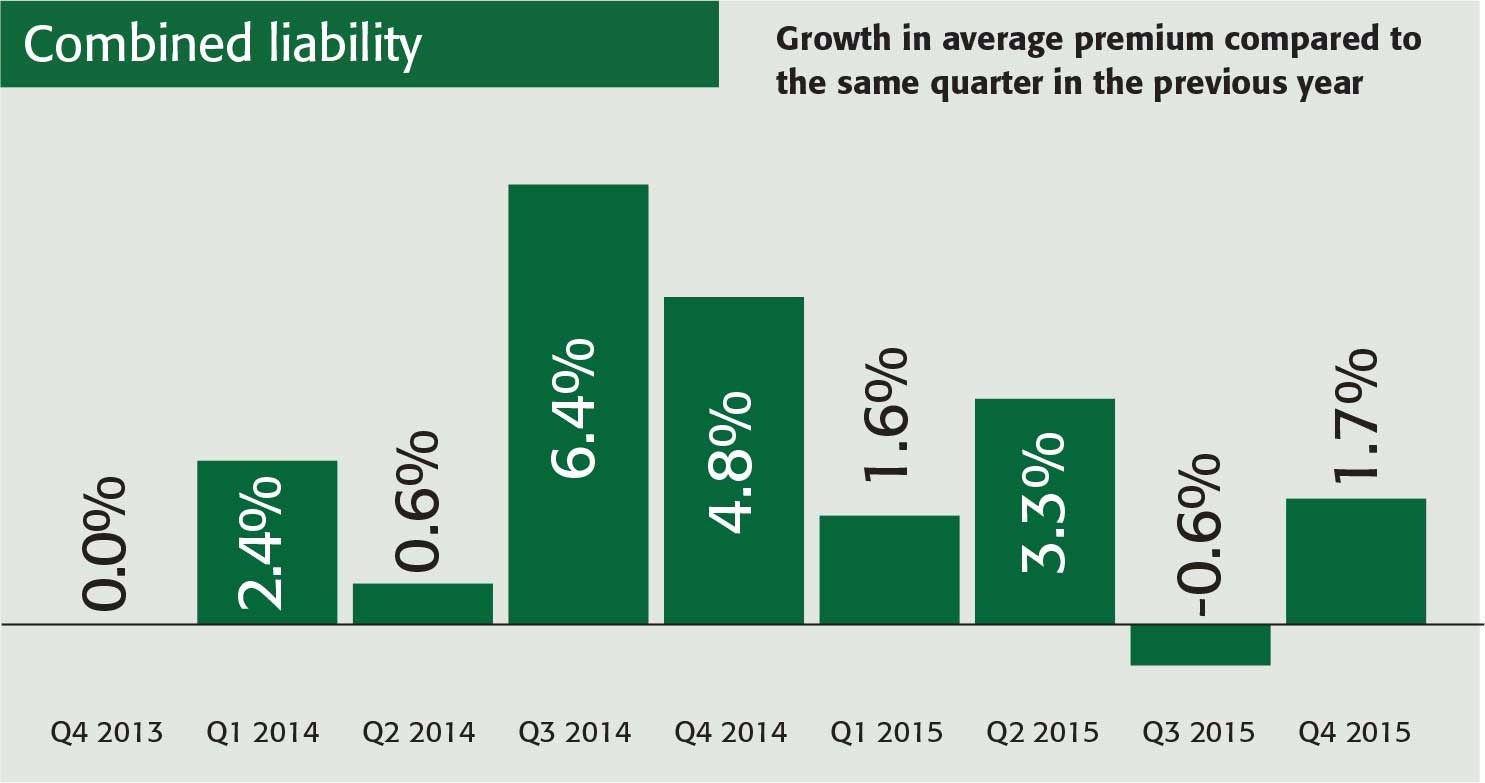

The two big risers in quarter four 2015 were tradesman and combined liability, which climbed by 2.5% and 1.7% respectively set against the same period a year earlier. But the performance of both classes of business in the final quarter of 2014 was significantly better (tradesman: 4.4%; combined liability: 4.8%) when contrasted with a year earlier.

Finlay Smith, UK commercial underwriting and pricing director at RSA, speaking about both products collectively in 2015’s fourth quarter, said the Acturis index doesn’t particularly reflect what his insurance company is seeing. He detailed that the provider has experienced continued price pressure and noted that tradesman is effectively a niche of combined liability.

“So what’s driving the similar movements there is deteriorating results in respect of what we’ve seen in terms of the claims environment around legal compensation and legislative changes.

“What we have seen is pressure on liability loss ratios in a market that’s really struggled to make money. We see underfunding for large losses and a mentality of only pricing for the attritional, which remains stubbornly high.” Referring to the index, Smith added it’s encouraging that the market thinks that price is hardening.

David Williams, technical director at Axa, took a different view on both classes of business and noted that tradesman covers are much more industrialised nowadays. “There’s almost personal lines style rating models being built in so I think you see less of the whims of individual underwriters and the chasing down of individual cases,” he elaborated.

“A lot of tradesman business, while it can produce big claims, is really low premium volume stuff and therefore what that shows us is the increase that is necessary to keep pace with, particularly, bodily injury awards.”

Williams noted that throughout 2015 a lot of claims farming activity moved away from motor into the liability element, whether it’s deafness or slip and trips. On the subject of combined liability, he suggested at least two-and-a-half percent a year is needed in terms of claims inflation on liability claims, which has not been achieved. “I see 1.7% as being people realising that they’ve fallen behind the curve and I would hope that would increase again slightly in Q1 of 2016.”

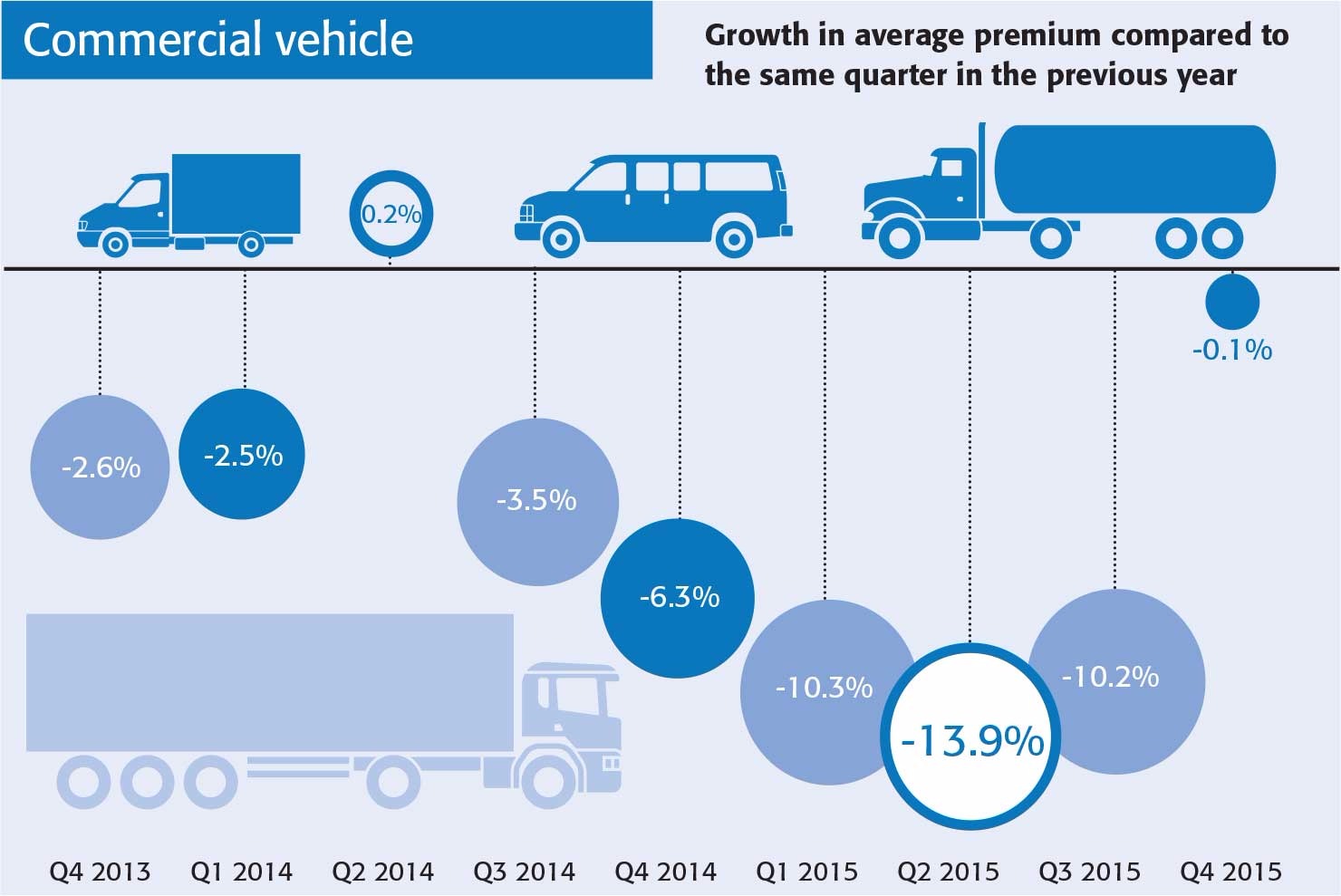

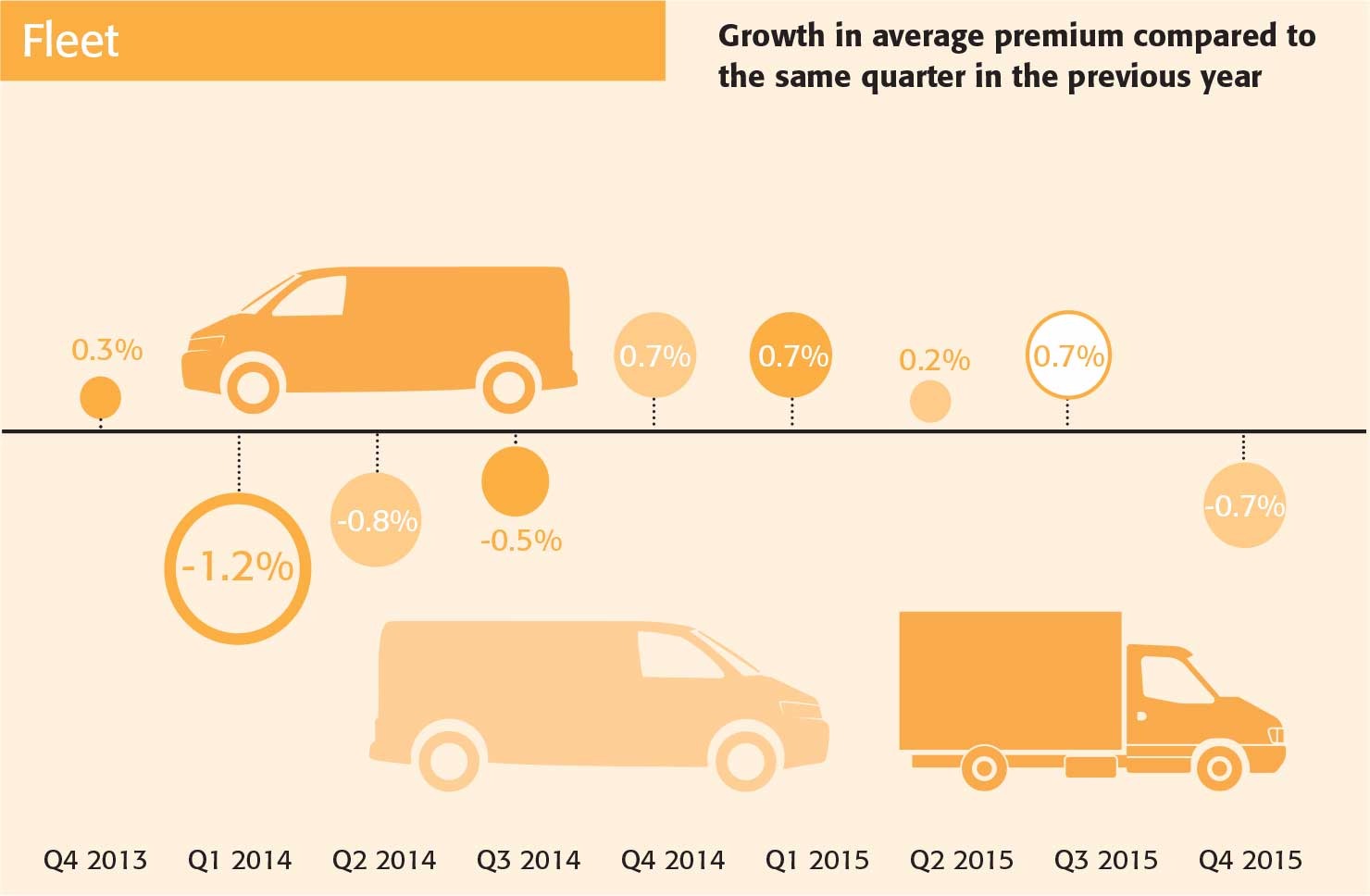

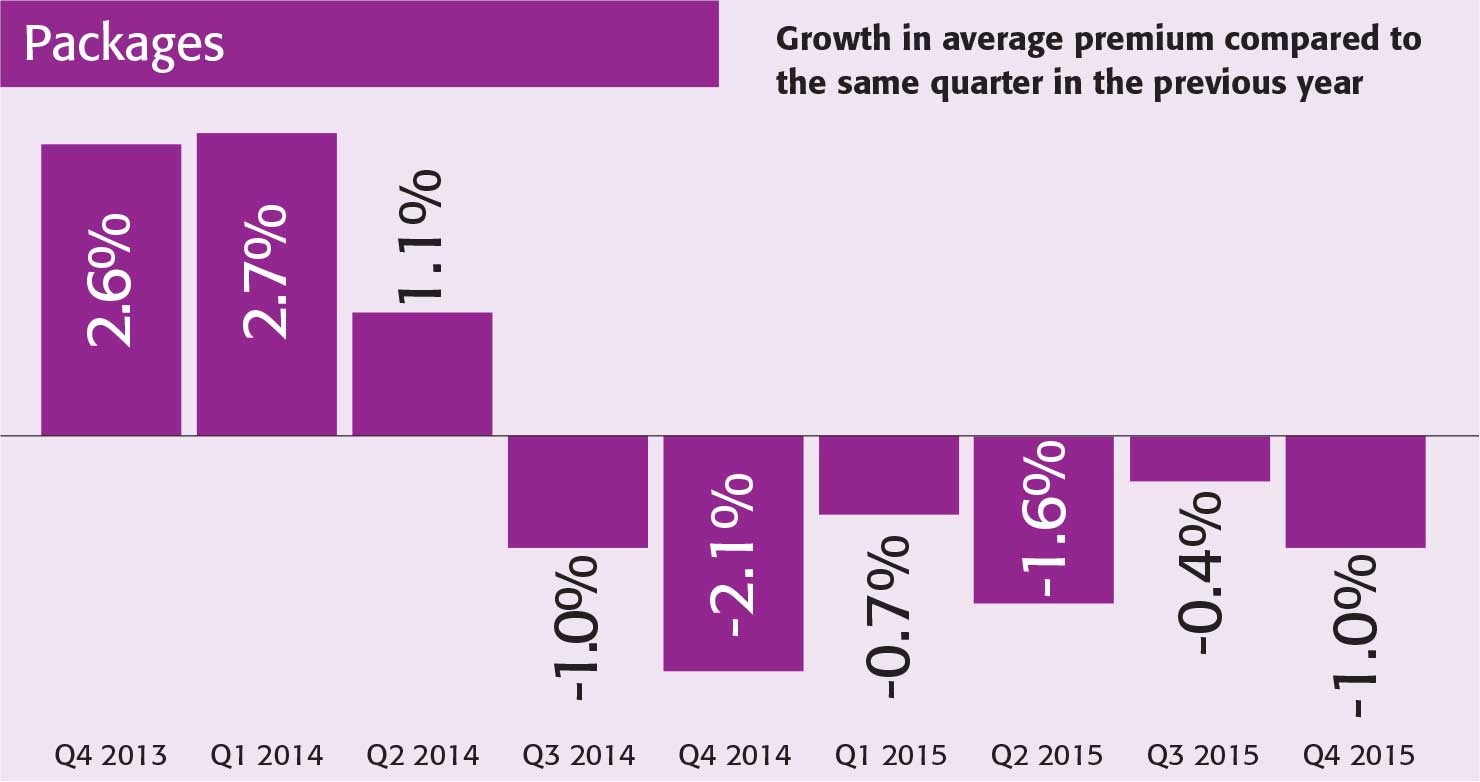

Turning to commercial vehicle, fleet and packages, those classes fell by 0.1%, 0.7% and 1.0% respectively when the last quarter of 2015 is compared with the equivalent period a year earlier. Leah remarked that he doesn’t think there’s much more room to fall in commercial vehicle following previous quarters, and it appears reductions have been factored in and the market is stabilising.

Smith, however, observed that he was slightly surprised by the downward trend because they’ve seen results deteriorate and therefore rate goes up. He expects the increases in fleet recorded for the first three quarters last year to resume and suggested the last quarter was probably a blip as firms tried to meet their end-of-year top line target. Roberts commented that packages is still so competitive and a line of business insurers want to write.

Euros Jones, commercial lines director at LV, gave his view on the general performance of the indices. “The underlying performances on CORs were improving but there is a continuing competitive market and also the floods at year end would reinforce the need for insurers to execute more sophisticated strategies to improve their CORs in 2016.”

Williams noted property was the line of business doing best for everyone until the bad weather. Smith added that for commercial combined and property owners it will be interesting to see if the floods have any stiffening effect on rate trajectory.

With hopes abounding for improvements in 2016 the next instalment of the Acturis premium indices will surely be eagerly anticipated.

Stats archive

Stats - February 2016 | Stats - December 2015 | Stats - November 2015 | Stats - October 2015 | Stats - September 2015 | Stats - July 2015 | Stats - June 2015 | Stats - May 2015 | Stats - April 2015 | Stats - March 2015 | Stats - February 2015 | Stats - December 2014 | Stats - Novemebr 2014 | Stats - October 2014 | Stats - September 2014 | Stats - July 2014 | Stats - June 2014 | Stats - May 2014 | Stats - April 2014 | Stats - March 2014 | Stats - February 2014 | Stats - December 2013 | Stats - November 2013 | Stats - October 2013 | Stats - September 2013 | Stats - August 2013 | Stats - July 2013 | Stats - June 2013 | Stats - May 2013 | Stats - Apr 2013 | Stats - Mar 2013 | Stats - Feb 2013 | Stats - January 2013 | Stats - December 2012 | Stats - November 2012 | Stats - October 2012 | Stats - September 2012 | Stats - August 2012 | Stats - July 2012 | Stats - June 2012 | Stats - May 2012 | Stats - April 2012