Emmanuel Kenning

Content editor, Insurance Age

Emmanuel is the content editor of Insurance Age and has over fifteen years of experience writing about the insurance industry.

Well connected with the broking community he is now in his second stint at Insurance Age.

He started his career as a reporter on broker-focused title Professional Broking in 2009 becoming a senior reporter ahead of joining Insurance Age at the end of 2010.

Promoted to features editor in October 2011 Emmanuel became editor the following June holding the post for nearly six years before deciding to return to being a reporter to focus on news writing and analysis.

Along with deep knowledge of insurance he has also gained a solid understanding of reinsurance through a year writing on the market with a particular focus on insurance-linked securities at Trading Risk.

He re-joined Infopro-Digital in late 2019 taking up the position of senior reporter at Post working on the broking beat.

Emmanuel returned to Insurance Age in February 2022 to lead the news team. He focuses on bringing in and editing exclusive news and analyses along with keeping readers up to date on company announcements throughout the sector.

He also supports the editor across videos, podcasts, events, profile interviews, data driven research, opinion pieces and more to help keep Insurance Age ahead of the competition.

Follow Emmanuel

Articles by Emmanuel Kenning

Solicitor responds to Jack Straw on referral fees

Des Collins, senior partner of Collins Solicitors, has welcomed Jack Straw’s comments on the need to clamp down on claims management companies and ban referral fees.

FCA to be tougher and bolder

The Financial Services Authority (FSA) has declared that its successor body, charged with conduct and markets regulation from the end of 2012, will be tougher, bolder and more engaged with consumers.

Jack Straw attacks referral fee system

Former Secretary of State for Justice, Jack Straw MP, has called for referral fees to be banned in an article published in The Times.

FSCS adds journalist to board

The Financial Services Authority has appointed Liz Barclay, David Weymouth and Jayne Nickalls as non-executive directors to the board of the Financial Services Compensation Scheme (FSCS).

Towergate kicks off acquisition spree with modest purchase

Towergate Insurance has purchased Tunbridge Wells-based BWA (Insurance Services) for an undisclosed sum.

Businesses wasting £1.4bn annually on corporate hospitality

UK businesses are wasting up to £1.4bn a year through unnecessary and avoidable weaknesses in the planning and execution of their corporate events and hospitality programmes, according to gdz event analysts.

E-broking 2011: E-trading capability will develop to achieve premiums of all sizes in future

At Insurance Age’s inaugural e-broking event, Andy Heap, director of Digital Reach, questioned current assumptions about e-trading and assessed how the situation would develop describing technology as “very clever people coding human behaviour.”

Get involved with Insurance Age’s Network Spotlight

Insurance Age has secured video interviews with 11 of the leading broker networks in the insurance market and during July the senior leaders will be put under the spotlight to answer your questions.

Sterling uncovers broker confidence schism

Research by Sterling Insurance has revealed that 65% of brokers are confident about commercial lines business growth prospects in the next 12 months while over half saw no prospect of growth in personal lines.

Elite declines to enter solicitors’ PI market

Elite Insurance, has decided against entering the solicitors’ professional indemnity (PI) insurance market this year reversing initial suggestions it would.

Legal experts criticise PRA announcement

The legal sector has roundly criticised the contents of the Financial Services Authority (FSA) and Bank of England’s joint paper describing it as worrying and raising more questions than answers.

Authorities set out PRA approach

The Bank of England and the Financial Services Authority (FSA) have published a joint paper setting out the current thinking on how the future Prudential Regulation Authority (PRA) will approach the supervision of insurers.

Continuous Insurance Enforcement commences

The Continuous Insurance Enforcement (CIE) legislation has come into force meaning warning letters will be sent to the registered keepers of uninsured vehicles.

Brokers warn that lessons not learnt from Independent

On the tenth anniversary of the demise of Independent Insurance brokers have expressed their fears that the insurance industry has not learnt from the insurer’s collapse.

Creating FCA and PRA to cost up to £175m

The Treasury has estimated that the cost of establishing the Prudential Regulation Authority (PRA) and transforming the Financial Services Authority (FSA) into the Financial Conduct Authority (FCA) could be between £115m-£175m.

HSBC gets extension to PPI complaints procedure

The Financial Services Authority (FSA) has confirmed that it has agreed to temporary arrangements for HSBC to handle payment protection insurance (PPI) complaints.

Independent 10 years on - the broker response

Ahead of the tenth anniversary of Independent Insurance going bust Insurance Age has canvassed opinion in the broker market asking what impact it had and whether the industry has learnt any lessons.

Select & Protect enters non-standard home insurance market

Select & Protect has launched a non-standard risk home insurance product for brokers aimed at customers struggling to find cover due to criteria such as a flood risk property, adverse claims history or criminal convictions.

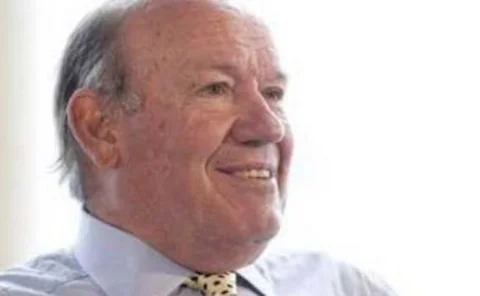

John McFarlane revealed as next chairman at Aviva

Aviva has announced that John McFarlane will take up the position of chairman from Lord Sharman at the end of June 2012.

Markerstudy buys vehicle repair group

Markerstudy has bought £500m revenue firm Tonbridge Coachworks Vehicle Repair Group.

FSA increases Sants’ car bill by £31,000

The Financial Services Authority (FSA) has admitted it under reported the cost of chief executive Hector Sants’ car benefits by £31,056 in 2010, according to The Times.

Brokers declare support for central database of fraudsters

The vast majority of brokers feel penalties for insurance fraud should be higher and a central database of fraudsters, used at point of sale, would help to deter fraud according to a survey by Groupama Insurances.

Financial confidence falling, research says

Research from Axa has revealed that 40% of consumers have made significant spending cutbacks since the end of last year with financial confidence continuing to fall.

FSA publishes Annual Report for 2010/11

The Financial Services Authority (FSA) has published its annual report for 2010/11, outlining its performance against the priorities set out in its 2010/11 Business Plan and its statutory objectives.